As a global leader in the coffee industry, Starbucks has long been a stalwart of the stock market. For decades, investors have seen potential and tremendous opportunities in owning shares of this iconic brand.

With its vast network of over 32,655 stores across 77 countries and offering an array of ready-to-drink products and other merchandise, Starbucks has become a household name – making it an attractive option for many investors seeking to diversify their portfolios.

This post aims to provide readers with in-depth financial analysis and insight into how they might approach investing in Starbucks stock. This article will answer all your questions by examining the company’s past performance and current position.

Introduce the company and its history.

Starbucks was founded in 1971 by three friends, Jerry Baldwin, Gordon Bowker, and Zev Siegel. Their mission was to create a “third place” outside the home and work where people could relax and enjoy quality coffee.

Over the years, Starbucks has become an international phenomenon, with over 32 thousand stores spanning 77 countries. The Starbucks brand has become synonymous with quality and convenience, offering a variety of coffees, teas, and other products through its stores and partners.

Their product offerings have evolved to include ready-to-drink beverages, pastries, snacks, breakfast sandwiches, and more. Despite its competitive marketplace, Starbucks is still a top player in the coffee industry, making them an attractive option for investors.

Given its long and successful history, Starbucks stock has become an appealing investment option for many individuals and institutions looking to diversify their portfolios.

As such, this article provides readers with a comprehensive financial analysis of Starbucks stock so that they can make informed decisions about their investments.

Discuss the financial performance of Starbucks over the past few years.

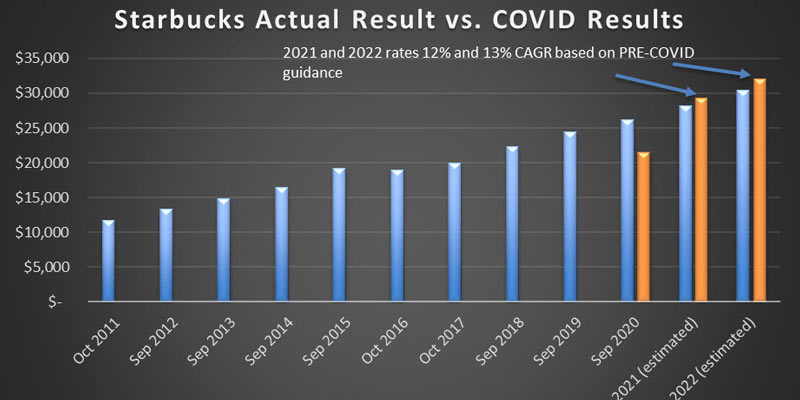

Over the past few years, Starbucks has seen impressive financial performance. In the fiscal year 2020, their total revenues grew by 10% to a record high of $26.5 billion. Increased demand, steady customer loyalty, successful new product offerings, and store openings in key markets worldwide drove this growth.

Their earnings per share also increased from $2.33 to $3.15, while their operating income jumped by 12% to a record high of $4.6 billion for the year. While its net capital spending declined slightly, Starbucks generated a positive cash flow of approximately 1.17 billion dollars.

Furthermore, Starbucks reduced its long-term debt by 4.1 billion dollars, largely due to strong operating cash flows and prudent management of its capital structure.

These impressive financial results underscore the company’s ability to keep pace with changing consumer preferences and execute its growth strategy while navigating an uncertain macroeconomic environment. This has enabled Starbucks to remain a top performer in the coffee industry and an attractive investment option.

Overall, the financial performance of Starbucks over the past few years has been very strong and provides investors with confidence that their investments are safe and will be rewarded handsomely.

Discuss the risks and rewards of investing in Starbucks stock.

Like any other investment, risks, and rewards are associated with investing in Starbucks stock. The company’s financial performance over the past few years has been impressive, but this does not guarantee that similar results will continue.

There are several potential risks that investors should consider when evaluating Starbucks stock. These include macroeconomic changes, competition from other companies in the food and beverage industry, changing consumer preferences, and the company’s ability to maintain market share.

Despite these risks, however, there is still a great opportunity for long-term growth for Starbucks investors. The company has consistently delivered strong financial results and is well-positioned to continue growing.

In addition, Starbucks has a significant competitive advantage due to its brand recognition, customer loyalty, and global reach. These characteristics make Starbucks stock an attractive investment option for many individuals and institutions.

Analyze what factors have contributed to this success or failure.

The success of Starbucks over the past few years can be attributed to several factors. Firstly, the company has been able to respond quickly and effectively to changing customer preferences and needs.

They have consistently launched innovative new products, such as their bottled Frappuccino range, that have kept customers coming back time after time. They have also invested heavily in digital technology, offering customers an increasingly seamless and convenient shopping experience.

Moreover, Starbucks has been successful in its efforts to expand into new markets both domestically and internationally. This has widened their customer base and enabled them to capitalize on the growing demand for premium coffee products.

Starbucks has also implemented cost-cutting measures such as closing underperforming stores, renegotiating lease terms, and streamlining its supply chain. This has allowed them to maintain a healthy bottom line and grow profits year after year.

Finally, the strong financial performance of Starbucks over the past few years can be attributed to its sound management practices. Their executives have made prudent investments and resource allocation decisions, enabling the company to remain competitive in a highly saturated market.

These factors have contributed significantly to Starbucks’ impressive financial performance and continued success over the past few years. The success of this coffee giant provides investors with a strong indication that the company will likely remain a top performer in the industry for years to come.

Make predictions about Starbucks stock.

Predictions of Starbucks stock in the coming years suggest that it will continue its trend of strong financial performance. Analysts expect revenue growth to remain steady, driven by continued customer loyalty and demand for new products.

Additionally, with their renewed focus on international expansion, they are expected to capitalize on the rising demand for premium coffee worldwide.

Moreover, Starbucks is expected to maintain its successful cost-cutting measures and generate positive cash flow. This will enable them to remain competitive in the face of rising labor costs and other operating expenses.

Finally, investors anticipate that Starbucks’ stock price will likely appreciate further as they continue innovating and investing in digital technology. This will enable them to offer customers a more streamlined shopping experience and increase customer loyalty.

Overall, the current outlook for Starbucks’ stock is quite positive, and investors should expect solid returns in the coming years.

This coffee giant has consistently demonstrated strong financial results and has effectively navigated an uncertain macroeconomic environment. This gives investors confidence that their investments are safe and will be rewarded handsomely.

Offer advice for investors considering buying company shares.

Investors who are considering buying shares in Starbucks should take a few key factors into account. Firstly, they should familiarize themselves with the company’s financial performance over the past few years and analyze any potential risks associated with investing in their stock.

Additionally, investors should assess the current state of the global economy and the competitive landscape for premium coffee products and services. This will enable them to determine whether Starbucks will likely remain a top performer in their industry.

Furthermore, investors should pay close attention to news regarding new product releases or changes to Starbucks’ strategy. These developments could potentially affect the company’s stock price and performance in the future.

Finally, investors should consider diversifying their portfolio by investing in other industries or sectors less dependent on macroeconomic conditions. This will help them mitigate potential losses related to Starbucks’ stock price fluctuations.

Overall, investors considering buying shares in Starbucks should do their due diligence and research the company thoroughly. This will enable them to make an informed decision regarding their investment and ensure that they can maximize their returns in the long run.

FAQs

How has Starbucks stock performed over time?

Since its initial public offering in 1992, Starbucks stock has performed exceptionally well. The company’s stock price has experienced significant growth and has consistently gained value over time. In 2018, Starbucks' stock rose to an all-time high of $72 per share.

What factors have contributed to Starbucks’ success?

Starbucks’ success can be attributed to several key factors. Firstly, the company has successfully differentiated itself from competitors by offering high-quality products and services that appeal to many customers.

What is Starbucks' dividend yield?

The key drivers of Starbucks' stock price include global demand for premium coffee products, cost-cutting measures, and technological innovations.

The company's strong financial performance and regular dividend payments have also contributed to its stock's positive performance. Currently, Starbucks' dividend yield is 1.2%.

Conclusion

Investing in Starbucks stock is a great option for those with a long-term outlook. Despite its current challenges, its underlying principles remain the same. The company has unparalleled brand recognition and customer loyalty.